Have you ever considered going solar? Solar incentives, tax credits and rebates from the state offer different ways to finance your green energy upgrade.

By Gabriel Wolford

Photo Credit: Gabriel Wolford

A sun tracking solar panel situated behind the Lombardo Welcome Center at Millersville University.

As the pressure to go solar continues to increase, many states have assembled programs that give homeowners the opportunities to go green. Pennsylvania has started a program allowing residents and businesses to leverage various solar incentives. These can reduce upfront costs, give tax benefits, and contribute to a cleaner environment. This article explores the solar incentives available in Pennsylvania and local communities, their benefits, and how they align with state and federal renewable energy goals.

Why Go Solar?

Solar energy offers significant environmental and economic advantages. Solar power systems reduce greenhouse gas emissions and dependence on non-renewable resources. Solar can also reduce or eliminate reliance on the power grid. In off-grid systems, homes are powered solely by solar and have no connection to the outside power grid. Additionally, Pennsylvania ranks at #21 in the US for solar capacity. This is partially due to the size of the state and the weather conditions we experience. Switching to solar can significantly lower electricity costs over time. Homeowners and businesses can capitalize on financial incentives that make solar installations more affordable. This can produce a quicker return on investment and savings over the course of a few years. State energy buyback programs can also add to these savings, more on that later.

Federal Solar Investment Tax Credit (ITC)

One of the most attractive solar incentives available to Pennsylvanians is the federal Solar Investment Tax Credit (ITC). This credit allows homeowners and businesses to deduct a significant percentage of the cost of their solar install from their federal taxes. In 2024, the ITC offers a 30% tax credit for solar installations completed by residential and commercial properties (U.S. Department of Energy). This incentive, coupled with declining installation costs, makes solar energy a viable option for many.

Pennsylvania Solar Energy Buyback Programs

Net Metering – Pennsylvania’s net metering policy allows solar system owners to offset electricity costs by sending excess power back to the grid. This is effectively a reversal of how your power is normally measured. Utility companies will read how much power has been sent back into the grid and provide credits for surplus energy. These credits can be used to reduce future electricity bills (Pennsylvania Public Utility Commission). Net metering ensures that homeowners and businesses maximize the value of their solar installations year-round.

Solar Renewable Energy Certificates (SRECs) – The state’s Alternative Energy Portfolio Standards (AEPS) program requires electricity suppliers to source a portion of their energy from solar power. To comply, suppliers purchase Solar Renewable Energy Certificates (SRECs) from solar system owners.

Photo Credit: Gabriel Wolford

Typical power meter found on North American homes.

Solar Payback Period

- Solar system is installed and payed for with tax credit or other incentive

- System goes into use reducing energy footprint and costs

- The energy bill offset and associated savings add up

- The initial cost of the system is covered by the savings it generates

Solarize Philly

This local program aims to bring solar power to more homes and businesses in the City of Philadelphia. The program, started by the Philadelphia Energy Authority (PEA), aims to “make the process of installing solar as easy and affordable as possible, while also supporting solar training at the School District of Philadelphia and improving access to clean energy for all neighborhoods.” (Philadelphia Energy Authority) PEA has partnered with local solar installers to provide solar panels, inverters, batteries, and other necessary equipment. The program also offers discounts and consumer protection plans for Philadelphians wishing to go solar.

Photo Credit: Gabriel Wolford

Typical Solar Panel, Courtesy of MU Meteorology

Off-Grid Solar

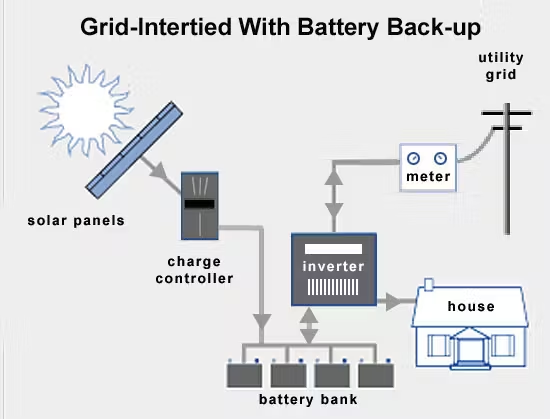

Off-grid solar systems are independent power solutions that generate electricity using solar panels, without relying on the electrical grid. These systems are ideal for remote areas, emergency backups, and those trying to move away from traditional power sources. They typically include solar panels, a solar charge controller, a battery storage system, and an inverter to convert DC to AC electricity for household use. Off-grid solar can provide clean, renewable energy and alleviate homeowner’s reliance on the power grid. It supports sustainable living by reducing carbon footprints and often pays for itself in 6 to 8 years. Advances in battery technology and panel efficiency have made off-grid solar increasingly affordable and accessible for homes, businesses, and rural communities.

Diagram Credit: Unbound Solar

A diagram of a system capable of feeding power back to the grid.

Micro Hydro

Micro hydro systems harness the power of flowing water to generate electricity on a small scale, typically for individual homes, businesses, or small communities. These systems use turbines, generators, charge controllers and inverters to convert the movement of water into electrical power. Ideal for locations with steady and predictable water sources like streams or creeks, micro hydro systems can provide consistent, renewable energy with minimal environmental impact. They can operate independently or as part of hybrid energy systems including wind and solar. Advantages of micro hydro include low operational costs, long system lifespan, and the ability to produce power 24/7. Micro hydro is a sustainable solution for rural electrification and off-grid energy needs.

Bright Eye Solar is a local solar system installer in the Lancaster County and features some of the federal and state solar incentives. This is quoted from their website, “Before you can install solar panels on your property, you need to have a site survey and initial consultation. Solar energy isn’t a one-size-fits-all solution, which is why our experts review your budget, timeline, and property specifics. We also assess your home or commercial property’s energy usage to see if there are any adjustments you should make before installing solar panels in order to get the most value out of your investment.”

This is just one of many companies in the area to choose from.

Dr. Litowitz is a professor and former chair of the Department of Applied Engineering, Safety & Technology at Millersville University. He is an invaluable source on renewable energy and power systems and a co-author of Energy, Power, and Transportation Technology, a power systems textbook. When asked about the future viability of solar installations, he returned with “The technology and the cost of installation both continue to improve for homeowners.” He continued with that idea, saying “a typical residential installation for photovoltaic electricity would yield about a 6 to 7 year payback assuming a wide open roof with a mostly southern exposure.” Dr. Litowitz’s knowledge in this area is spot-on and he hands this off to his students at Millersville.

References

Grid tie Solar Power Systems Resources Center. Unbound Solar. (2020, March 18). https://unboundsolar.com/solar-information/gridtie-information

Pennsylvania Public Utility Commission. (n.d.). Renewable Energy – Consumer Education – Electricity: PUC. PA PUC. https://www.puc.pa.gov/electricity/renewable-energy/

Philadelphia Energy Authority. (n.d.). Solarize Philly. https://solarizephilly.org/

Residential Solar Panel installation. Bright Eye Solar. (2024, December 4). https://brighteyesolar.com/residential-solar-for-homeowners/residential-solar-panel-installation/

SEIA. (2024, November 7). Pennsylvania State Solar Overview. Solar Energy Industries Association. https://seia.org/state-solar-policy/pennsylvania-solar/

Solar States. (2023, April 11). SRECs for Pennsylvania residents – pennsylvania solar. SRECs for Pennsylvania Residents. https://www.solar-states.com/srecs-for-pennsylvania-residents/

US Department of Energy. (n.d.). Homeowner’s guide to the federal tax credit for solar photovoltaics | Department of Energy. US Department of Energy. https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit-solar-photovoltaics